| Home | FAQs | Book Contents | Updates & News | Downloads |

My experience from talking to senior executives in various oil companies has demonstrated (to my satisfaction at least) that the value of the technical data is consistently underestimated by them. This impression is certainly supported by looking at the budgets for handling data in almost all oil companies. As a "data handling expert", of course, I have to think that. As a sceptic and a cynic I want to see solid evidence of exactly how much the subsurface technical data is worth to an active oil company.

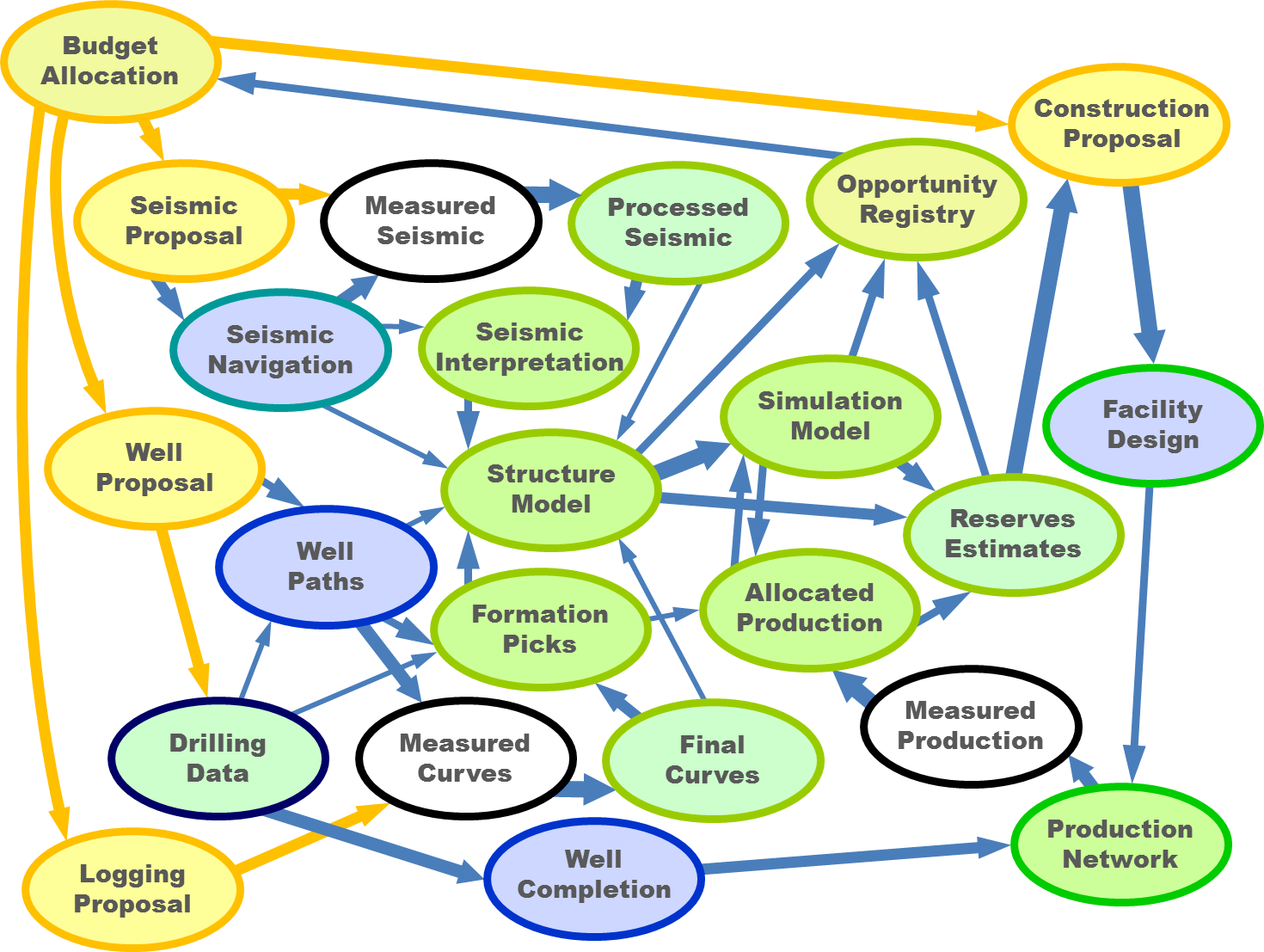

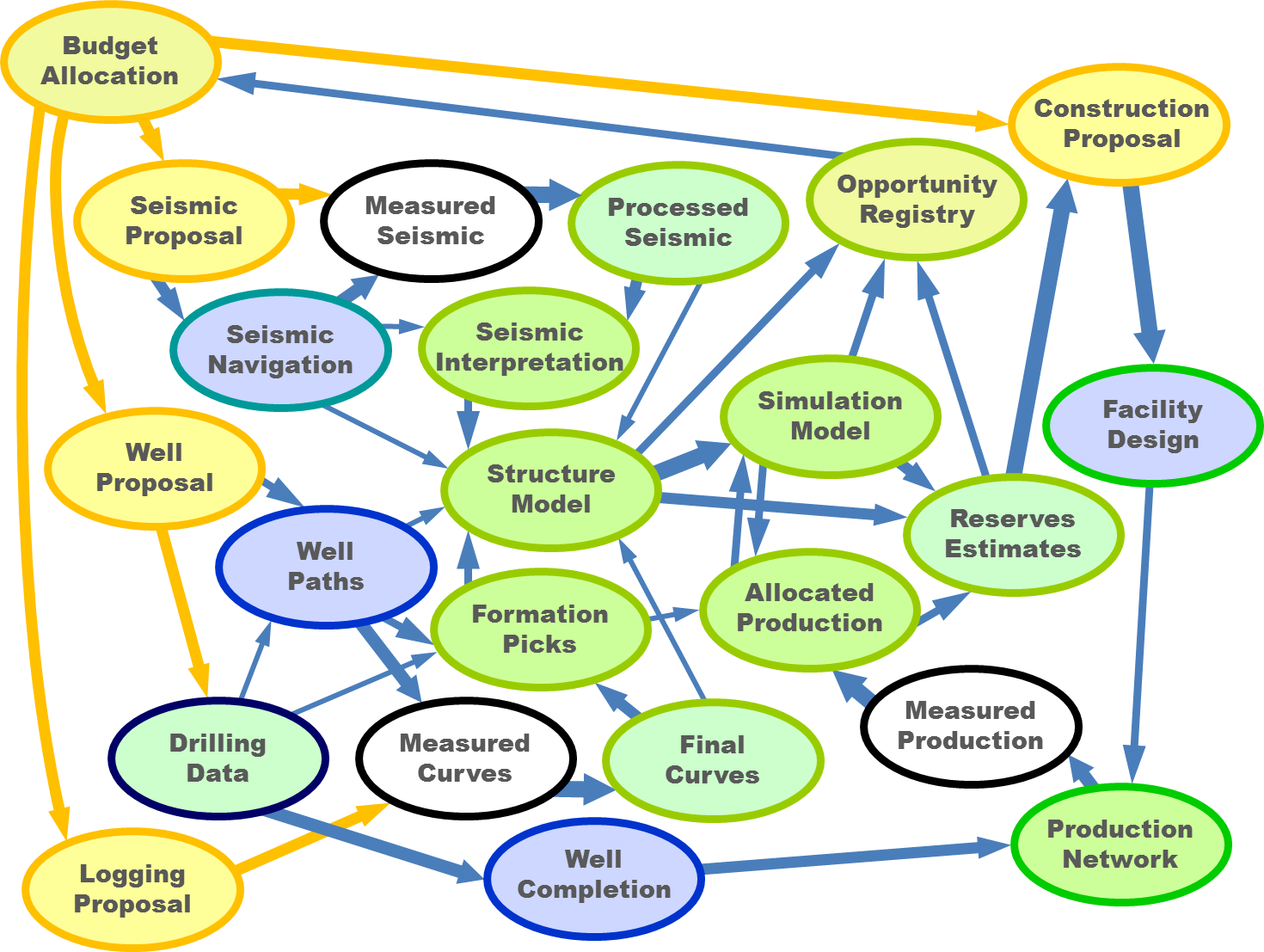

I have come across five different types of model which have been applied to estimate the impact that data has towards an oil company's success; corporate strategy; business decisions (and directly related costs); company processes; benchmarking; and, staff time budgets. Each one of these has different combination of advantages and limitations. Corporate strategy models, like the one we used in the CDA study, have to rely on the "best estimate" of parameters from executives and experts. Business decision models, such as the "value of information" (VOI) processes that many oil companies use, apply formal methods to associate particular costs with predefined outcomes but require a strictly limited scope. Company process models, like the one that Noah Consulting used for Hess in 2010, are complex to create and parameterize. Benchmarking models, are very difficult to make consistent across organisations (and hence, as I've argued before don't work... yet). Finally staff time budget models are easy to create but are at best misleading and at worst focused on completely the wrong things.

Whichever one of these models we adopt there is a similar process. First we have to embrace a theory about which elements are important and how they impact each other. Then, using that picture we measure aspects of the actual business in order to estimate values for the key parameters that reflect reality. Finally we exercise this model, both to demonstrate that its behaviour is not inconsistent with "real life" and, more importantly, to come to conclusions about how we can best improve outcomes. At each stage in this refinement process we discover that the assumptions we have made so far are too simplistic and have to be clarified and refined to ensure the ultimate usefulness of the result. Any model must be simple enough to be implemented yet realistic enough to ensure the conclusions reached will apply in reality.

Linear processes are easier to model, that's why up until the 1980s there was a focus on imposing order, doing things like defining assembly lines. Non-linear systems, where tiny inputs can effect enormous changes, especially when they are self-organising, require an understanding of chaos, fractal attractors and meta-stability. Such systems need more intricate models, otherwise the most important elements get left out. The processes involved in exploiting hydrocarbons clearly fall into this, more challenging group. I think we have to gather more experience in creating and exercising good models of oil company activities.

Article 38 |

Articles |

RSS Feed |

Updates |

Intro |

Book Contents |

All Figures |

Refs |

Downloads |

Links |

Purchase |

Contact Us |

Article 40 |