| Home | FAQs | Book Contents | Updates & News | Downloads |

The processes involved with running an effective oil company are intricate and complex. Perhaps rather than attempt to understand the whole Byzantine mess of activities required to efficiently discover and exploit sub-surface resources we could do better by focusing on a single business decision and tracking all the consequent costs and benefits? In the past I've called this type of approach "decision based". Often this would take the form of a "decision tree" (which usually works forward from the decision to the consequences).

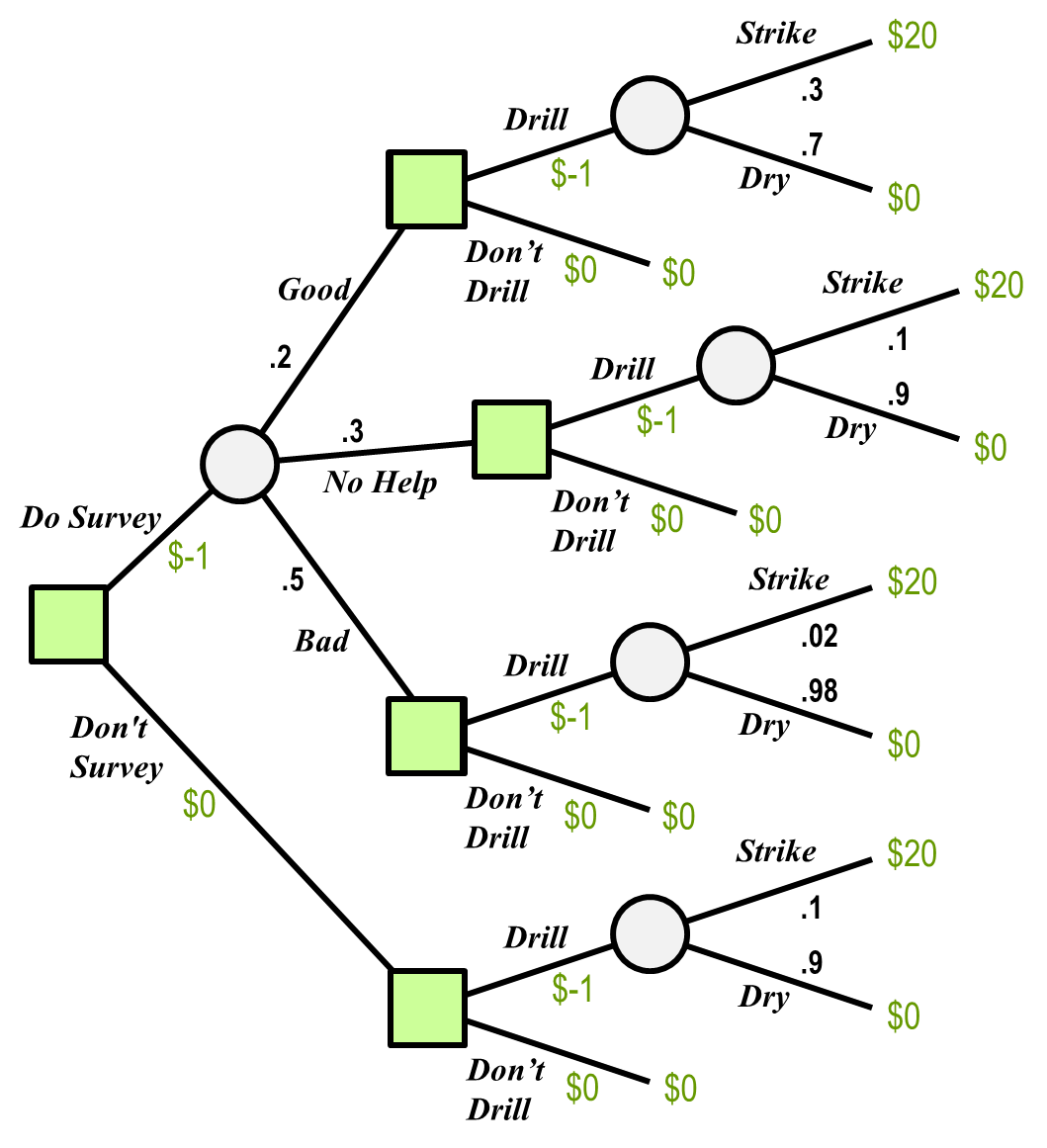

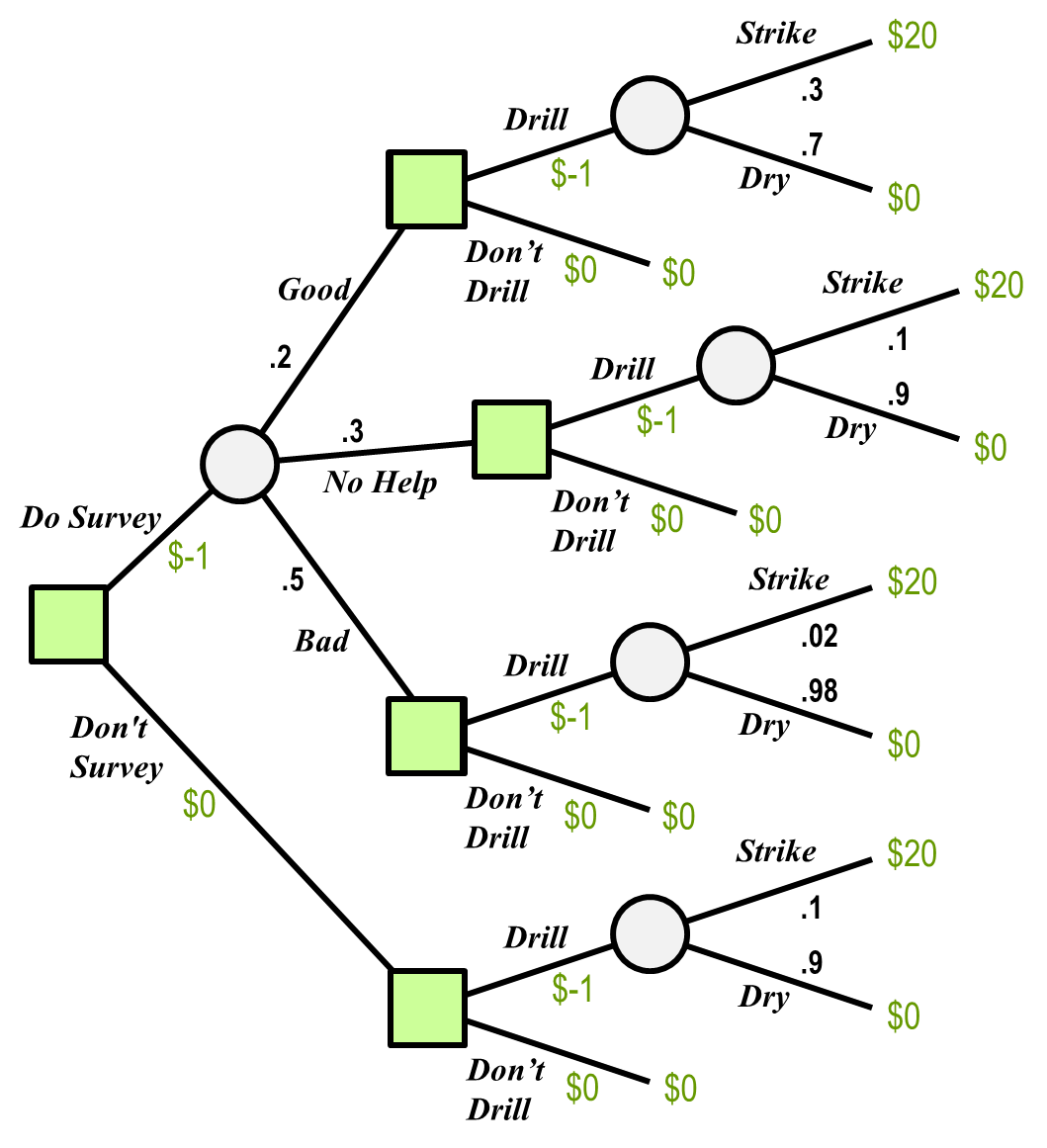

I don't know how familiar most people are with decision trees, so I'll include an example to make the later discussion easier to follow (I apologise to those who already know this stuff). Suppose we are thinking of drilling a new well, at the moment our estimate is that there is a 10% chance of generating $20M in production, but should we do a seismic survey costing $1M? The answer depends on how doing the survey will affect our assessment. Suppose that there are three possible outcomes, a good prognosis increases the chance of a strike to 30%, a bad one makes it 2% and otherwise it stays the same. If we assume the chance of a good prognosis is 20% and of a bad one 50% then working through the tree shown here shows that we're better off saving our survey costs and drilling without one.

The reason for doing this type of analysis is to uncover the implications that are inherent in our current understanding. This has two obvious limitations, first the "unknown unknowns" will almost always conspire to render analysis moot. The second issue was covered in a previous discussion on the TV game show "Deal or No Deal", which explained why simple arithmetic does not work with probability, having a 1% chance to win $100,000 is not the same as actually having $1,000 in your pocket. If your goal is to demonstrate, for example, the impact that a new measurement will have on the risk profile of a particular business decision and therefore justify the cost of gathering and analysing data then this technique fits.

If you're trying to work out the total consequence that emerges from a sequence of interrelated decisions and assumptions this is exactly the tool for you. In reality things never happen like that, each new data item has the capacity to reveal additional opportunities that were unimagined at the start. For the "value of information" process these are usually positive benefits, so the results provide a good "base case" and hence can justify a particular action. But at a strategic level we often want not just to limit our exposure to the bad times but also to have a good idea of the overall potential. If, instead of myopically focusing on a limited domain you want to appreciate the influence that this decision will have on the bigger picture, then this approach will deliver results whose applicability is limited.

Article 40 |

Articles |

RSS Feed |

Updates |

Intro |

Book Contents |

All Figures |

Refs |

Downloads |

Links |

Purchase |

Contact Us |

Article 42 |