| Home | FAQs | Book Contents | Updates & News | Downloads |

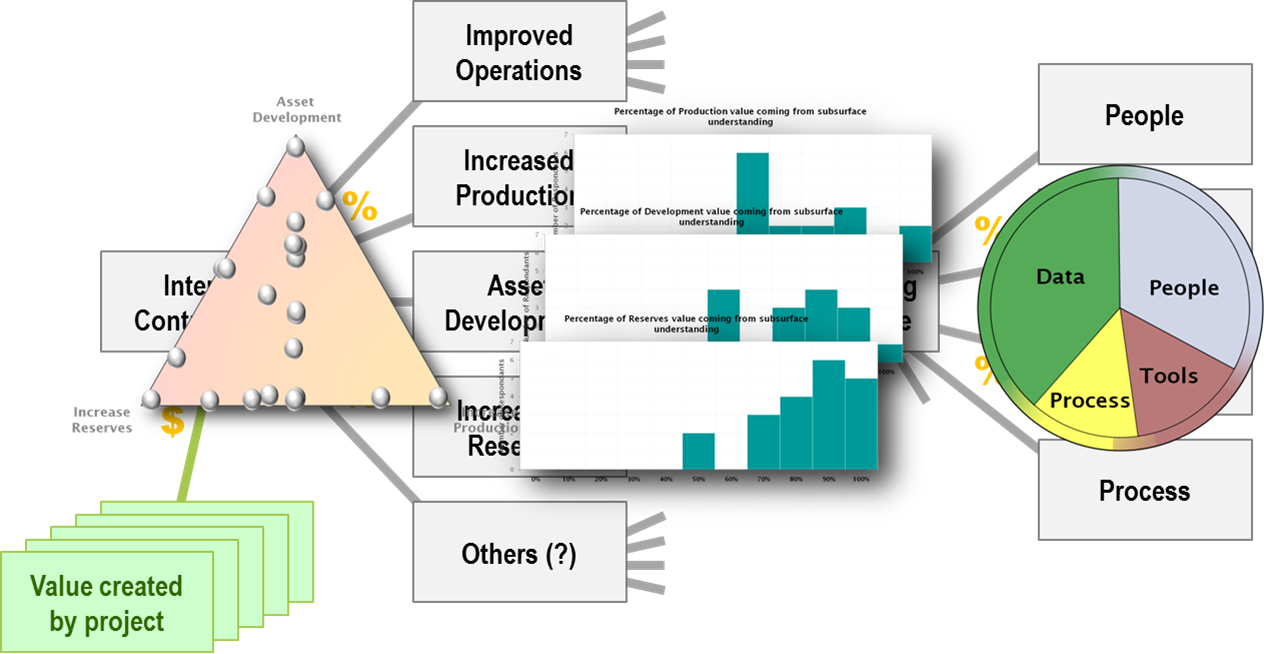

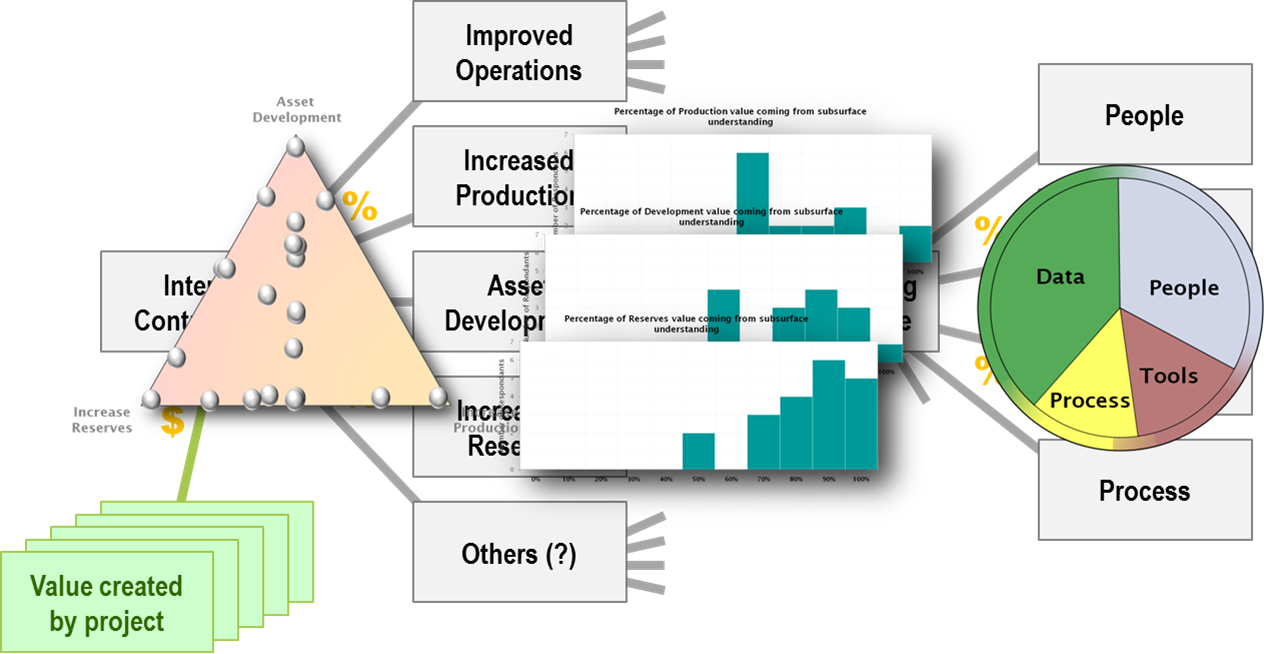

For the CDA report♠ we created a model of an oil company in order to examine the relationship between financial results and the technical data held within the organisation. In that case we had to incorporate a range of assumptions, for example that sub-surface data affected projects related to exploration, development and production. I remain happy with all the assumptions made. There were some short-cuts over the more complex oil company activities, I continue to believe that without those we could not have completed our report.

Previously I've claimed that there are two distinct types of business process models "corporate" and "process" ones. What I mean by this is that some models take a holistic approach and focus on a strategic view, while others concentrate on the details and enumerate as many facets as they can. A similar thing occurs in atmospheric modelling: "weather" models provide a picture that is accurate but only valid over a limited time frame; "climate" models, because they average weather over time, have results that are usually a much more reliable guide but isolated from specific incidents.

In the same way high-level corporate models rely on smoothing out the linkages between the components and the results. Like a climate model they can't predict if a particular project will succeed or fail, but they can indicate the overall influence that a new corporate strategy can be expected to deliver in the long term. Of course this distinction just highlights two ends of a spectrum, every model has to be a compromise between encapsulating enough detail to exhibit realistic responses and having so many parts that creating and using it is a challenge. For the CDA work, we started from the assumption that there was such a thing as "sub-surface technical data" and that this was of sufficient influence to significantly impact a company's overall results. Not a single one of the oil company executives questioned the existence of such a thing, or that it has a major effect on their business. Had they felt inclined to explore the details of what we meant by the term, and whether their definition was consistent with ours I'm sure there would have been quite a bit of a discussion, and maybe some disagreement.

Now don't misunderstand me, I am absolutely certain that this data exists and has a major impact on company results, but spending time exploring the exact scope of the term would have wasted the participants valuable time and distracted us from getting the input that we actually needed. Sometimes skipping over detail can help illuminate the real issues.

♠ "The business value case for data management - a study" is available from Common Data Access Ltd for free from http://www.oilandgasuk.co.uk/datamanagementvaluestudy/ if you have not yet downloaded it you should.

Article 41 |

Articles |

RSS Feed |

Updates |

Intro |

Book Contents |

All Figures |

Refs |

Downloads |

Links |

Purchase |

Contact Us |

Article 43 |